Car finance is one of the most popular ways to fund the purchase of a new car. Spreading the cost into manageable monthly payments could allow you to get a much better car than what you could afford if you were to fund the purchase with just your savings. Being able to secure the car against the finance package also can give you more protection than if you were to take out a personal loan.

A great way to see what sort of finance package you could get is by using a car finance calculator. By inputting a few details, you will be given an estimate of how much you could borrow and what it could cost you. Here’s our guide on how to use a car finance calculator.

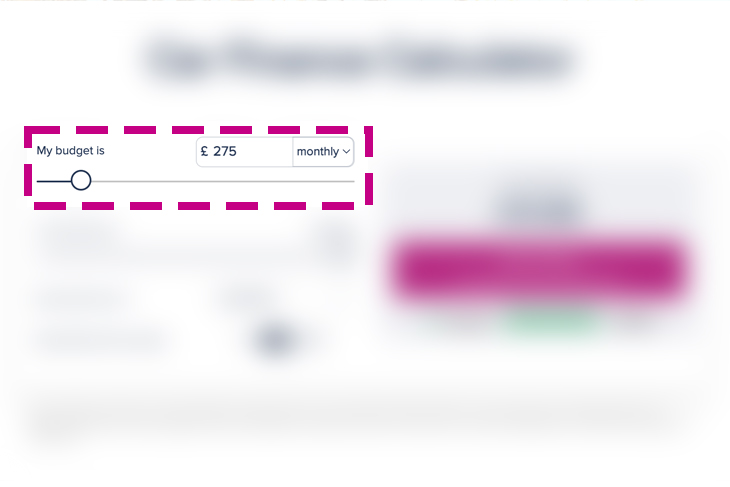

Budget

The first step is to put in your budget. This is how much you can afford each month to spend on a car finance package. It’s important that you are honest here. You don’t want a car finance deal to put a strain on your finances. Make sure you put in a realistic amount here, otherwise you will have to adjust your budget later and your quote will change.

Before you apply for car finance, it’s well worth going through your finances to get an accurate view of your monthly budget. Factor in all the bills and direct debits that you pay, and also set aside the money you use for the food shop and entertaining yourself. You don’t want to be doing nothing just because all your money has gone on your car!

Length of agreement

Next, it’s time to set how long you want the car finance package to last. This will affect the total cost of the finance package, and there are pros and cons of choosing a shorter or longer duration.

A shorter-term length means your monthly repayments will be higher, as the cost of the package is divided across fewer months. The plus side is that you will be paying less interest on the amount you borrow, as you will be paying the package off a lot quicker.

A longer-term length is the opposite. You pay more interest because you are borrowing the amount for a longer period of time. Monthly repayments are lower, because you are dividing it up into more chunks of time.

Have a think about which one appeals to you? Maybe think about what plans you have over the next few years, and whether you will want to have the car finance package completed before a big future purchase (like a house) or starting a family.

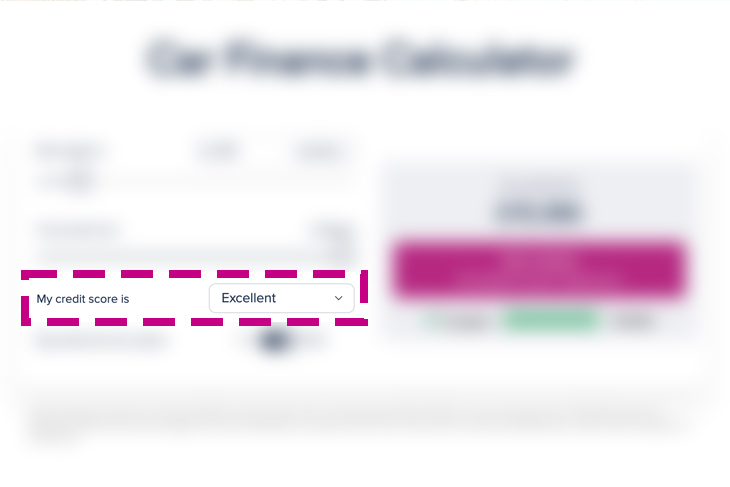

Credit score

Preferred loan option

The final thing to select is your preferred loan option. On the car finance calculator there are two options: personal contract purchase and hire purchase. Bear in mind that personal contract purchase is generally only available to those with a good or better credit score. You can still use this to get a quote, where you will be given more information about which products you qualify for.

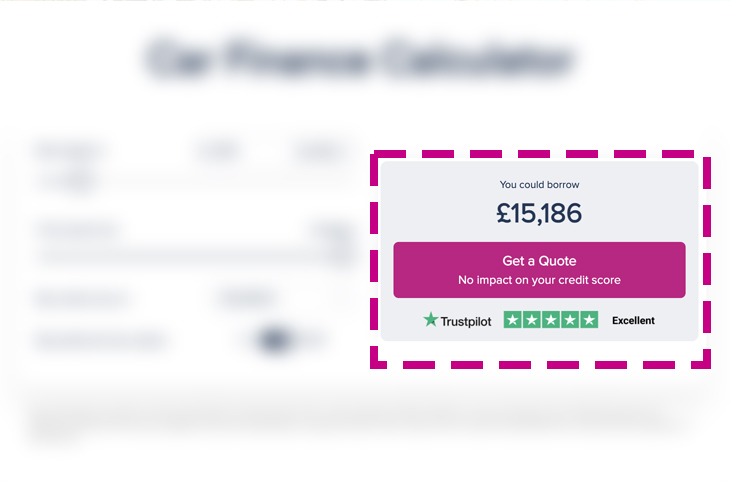

Your quote

Once you’ve adjusted all the previous settings, you’ll be given a quote of how much you could borrow. You can use this to see what sort of car you can afford to buy. If you have something in mind, then this can be a good way to see if you will be able to afford it. Otherwise, it gives you an idea of the price range you can play with.

If you want a more detailed quote, then you can click the button and put in a few more details. There is absolutely no obligation to buy and it won’t affect your credit rating at all. That way you can see exactly what car finance products are available to you, and get a range of quotes from a wide panel of different lenders.

What else do you need to consider?

Don’t forget, your quote doesn’t factor in any deposit. If you have a set amount set aside to go towards your new car, then you can add this to the quote to see what you can afford. A bigger deposit can also reduce the amount you pay overall, or you can use it to shorten the term length. Speak to a customer advisor and they will advise you on how you can best use your deposit to improve your quote. However, you do not need a deposit to apply for car finance. It’s beneficial to have one, but not an absolute requirement.

Are You Ready to Save on Car Finance?

If you’re considering getting a new car, then you don't want to miss out on what Creditplus can offer. Applying with us will not affect your credit profile, so why not complete a quick application now.

Apply Online Today!See our latest car deals

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube