When it comes to buying online, the advice is usually shop around for the best price. Car finance should be no different. To get the best rates and prices, you would want to compare car finance deals from a variety of different lenders and providers to see what is available to you. But that isn’t always possible. The problem with car finance is that in most cases you can’t find out what’s available to you until you apply. So how can you compare car finance deals without having to apply again and again? Here are some tips to help you find the right package for you.

Work out your credit rating

One of the best ways to work out the type of car finance package you can obtain is by calculating your credit rating. You can obtain a credit report for free from a number of online companies such as Experian. Using these companies will provide you with a full breakdown of your credit history as well as what finance providers are likely to rate your file (a rating of either Bad, Poor, Fair, Good or Excellent). Knowing how your credit history is likely to be assessed is a good way of seeing what rates you will have available. Headline rates are usually only open to those with a relatively spotless credit rating. If you know there is something in your history that is likely to have a negative affect, you can adjust your expectations.

Use online tools to assess what’s available

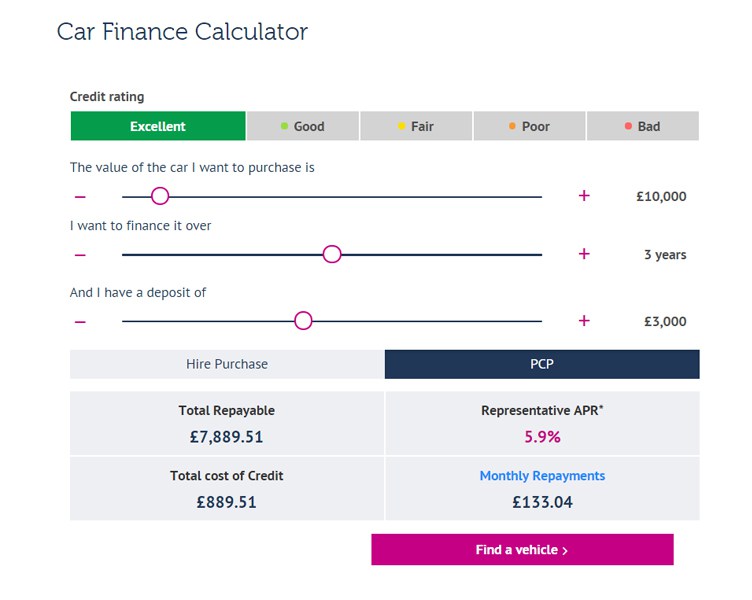

Before you apply with a finance provider or lender, use the tools they have available to assess your application. These tools can come in a variety of different ways. Here at Creditplus, we have a car finance calculator that will give you an idea of what finance package would be available to you and at what cost. You may want to use tools across a variety of different companies, both finance brokers and the lenders themselves, to see what they are offering.

Don’t apply to several companies at the same time

When you are trying to compare car finance packages, the temptation is to apply with a number of different companies at the same time. However this can seriously affect your credit rating. Every time you apply, a record of the finance provider assessing your application is added to your credit file. This footprint can be a warning sign to lenders, especially if you have a lot of them in a short space of time. Why? Because they will see this as a sign that you are desperate for credit, rather than trying to shop around for a good deal. So how can you effectively compare car finance packages and ensure you find the best deal for you?

Do apply to a finance provider that uses a soft credit search

A soft credit search does not leave a footprint on your file. This allows a finance provider to look at your credit history without having any affect on your credit file – vitally important if you are shopping around. When it comes to comparing car finance packages, Creditplus are the only car finance comparison service to offer this soft credit search. As part of our ethical lending policy, we have made it our mission to empower our customers with all the information they need to make the right decision on car finance. We compare over 100 lending options for our customers, providing them with an honest and accurate assessment of their finance options. That way the customer can compare car finance packages without affecting their credit rating.

Thinking of applying for car finance?

Read more on how Creditplus compare car finance deals for our customers and see how we can help you find the right deal. Remember, applying with Creditplus does not affect your credit file and we are happy to provide a no obligation quote so you can assess your options. Applying only takes 2 minutes and one of our customer advisors will be in touch to discuss your finance options, the car you want, and to answer any questions you may have over your car finance package. So if you are considering car finance, then choose Creditplus to compare car finance deals and find you the perfect package.

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube