If you have never taken out a car finance package before, then the different products available and their different quirks can be a little confusing. One of the most straightforward car finance products available is Hire Purchase. How does this car finance product work and is it right for you? Read on to have your car finance question answered by Creditplus.

How Hire Purchase works

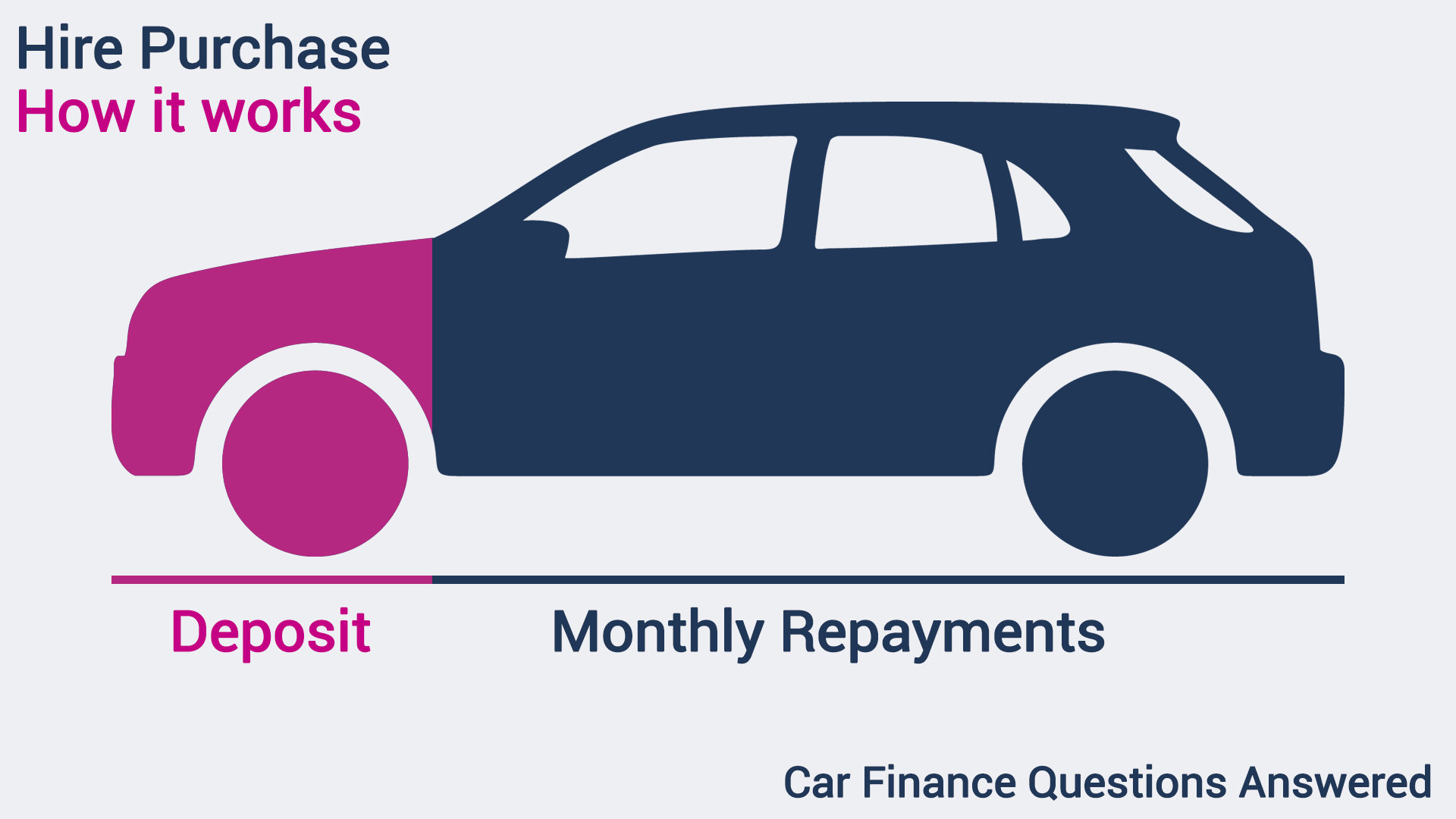

Hire Purchase is a car finance product that works by dividing the entire cost of the package – both the car and the interest – across fixed monthly payments. In most cases, you pay a deposit up front, but there are also zero deposit hire purchase options available.

So once you’ve found a car and a finance product to match (complete our quick online application form to get a no obligation quote on your finance options), the total cost of the finance package is calculated. This is the cost of the car and the cost of the finance package.

Hire purchase works with a fixed rate of interest, so the exact cost of the finance package can be calculated at the start of the agreement. This cost will vary depending on the interest rate you are offered, which will be based on your credit score, and the length of time you want the car finance package to last. Most packages have a duration between 36-60 months (3-5 years). You can reduce the total cost by using a deposit.

The total cost of the car finance package will then be divided across the length of the agreement into the monthly repayments. At the end of the agreement you own the vehicle outright.

What are the pros of Hire Purchase?

One of the biggest pros of a hire purchase car finance package is the fixed monthly cost across the length of the agreement. This allows you to efficiently budget for the cost of your car finance package across the duration of the package. With a finance package on a variable rate of interest, the cost of the monthly payment can change, sometimes becoming more expensive than at the start of the agreement.

Another pro of Hire Purchase is that you own the car at the end of the agreement. With many car finance packages and car leasing deals, you don’t automatically own the car at the end of the agreement, instead you either have the option to purchase for an additional fee or return the car to the lender.

Hire Purchase is also more readily available to customers without a spotless credit rating, with packages available to those with a fair, poor or bad credit rating.

What are the cons of Hire Purchase?

Hire purchase car finance agreements are all with a fixed rate of interest. That means you could potentially miss out on lower monthly payments on a variable rate of interest if that percentage was to drop at some point across the duration of the agreement.

Some customers also value the flexibility that other car finance products have at the end of the agreement, where you have the option to return the car, or refinance a different vehicle. If you want to change your car more often, then you may prefer a more flexible finance package.

How to get the best Hire Purchase car finance deal

If you feel like Hire Purchase could be the most suitable car finance package for you, then you’ll want to find the best possible deal. To do that, you’ll need to compare funding options from a wide panel of different lenders, including specialist lenders who work with customers with poor-to-bad credit ratings.

Creditplus compares over 80 lending options to help find our customers the best possible finance package. Whether that’s based on the amount of money you want to borrow or getting the best interest rate, your dedicated customer advisor will be working to find a package tailored to your personal circumstances. Once they’ve found the perfect hire purchase car finance deal, then you can focus on finding the perfect vehicle.

How to get the best Hire Purchase car finance deal

If you’re considering getting a new car, then you don't want to miss out on what Creditplus can offer. Applying with us will not affect your credit profile, so why not complete a quick application now.

Apply Online Today!See our latest car deals

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube